Goodbye 2020. And please, don’t come back.

Some of us were looking forward to 2021 since May or June of 2020. We are so happy to see the back of 2020 that we may be tempted to overlook that January 1st is no guarantee of a brighter future. This doesn’t mean that optimism is dead; instead, it highlights that now is perhaps our best opportunity to be practical. After all, if there is anything we learned from 2020, it’s what the German field marshall Moltke the Elder believed; “no plan survives contact with the enemy”.

Let us explain; take a minute and cast your mind back to January 1st 2020; before the threat of Covid-19 became our stark reality. Many of us had plans for travel, a new car, home repairs; the lists were both long and familiar. The year was spread out ahead of us on an inviting buffet table, and all we had to do was step forward, and fill our plates. We all know how that went.

Now ask yourself, what have you learned from 2020? One thing that comes to mind is that plans get changed, and far too often, it happens without warning. Some of these plans may even get thrown out completely; especially, when “an enemy” steps between you and your goal. This is why in our field marshall example, he was keen to have options; a plan B and maybe even a plan C and D.

But we are not field marshalls. And we don’t have the luxury of setting out multiple backup plans that will cover different scenarios. What we do have is a single, simple, fool-proof, tried and proven option that works, and works well; an emergency fund.

The emergency fund is exactly that; a fund we turn to in the event of an emergency. So rather than borrowing money to fix the broken screen that rendered your cellphone useless, you can take that money from your fund. Ideally, you want the fund to cover between three and six months’ expenses or salaries. If that sounds like a lot of money, it’s because it is a lot of money. And you won’t save that up overnight. But you should also think about how things may have worked out if you had a more significant piggy bank to dip into in 2020 when things took a turn for the worse.

Just like with any goal you have in life, getting started is often critical. We suggest that you start small, but start smart. You won’t regret it.

Start smart; look for the easy funds. Did you get a bonus this year; did your cousin repay you with some cash that they borrowed; did you get a tax refund; put some or even all of it to your emergency fund, no questions asked. These kinds of windfalls can burn holes in your pockets.

Start simple; trim non-essential expenses. You know what they are. They’re the things that you indulge in, but they probably don’t bring you lasting satisfaction. Ask yourself: do I need to see that movie the night it opens; will those fancy rims make my car more efficient; isn’t my homemade lasagne more filling than this fast food?

Also, start honestly; it’s essential to keep in mind that a 50% shoe sale does not constitute an emergency. Emergencies usually require your immediate attention. It’s unlikely that you will have any doubts about how pressing it is, when you get home to find the kitchen flooded because of a burst line under the sink.

Finally, there is one crucial thing about an emergency fund that will definitely jeopardise everything. And we can’t emphasise this enough, keep it separate from your other accounts. Don’t lump it with your living expenses or your savings account. This way it’s not as easy to “accidentally” spend some it on something else. Removing easy access significantly reduces temptation.

Now some of this may seem abstract, especially if this is the first time you are thinking about an emergency fund. We have some tips to help you with that; advice that will work, even after a year as tumultuous as 2020. Stay tuned, we will cover some of them in our next post. Until then, Stay Safe, and remember, Get Started.

Are you better prepared for 2021 than you were for 2020?

Many of us are happy to see the back of 2020. But are you prepared for what is yet to come?

Would you like to find out more?

Explore more from us

Two key questions to ask if you’re thinking about a mortgage

September 24, 2021

These tips will help you shape your approach to a mortgage and potentially save you time and money.

Five ways we can help you save money and save the planet

April 12, 2021

The credit union movement has a stellar history that includes both small steps and sure and steady planning.

Do you need to take control of your debt? Avoid these five mistakes.

March 1, 2021

Managing debt can be a daunting exercise, but it gets easier if you can avoid these five mistakes.

Key Steps to Start an Emergency Fund; even in a pandemic

February 1, 2021

An Emergency Fund is the type of financial backup that we all wish we had, and that many of us need.

Are you better prepared for 2021 than you were for 2020?

December 29, 2020

Many of us are happy to see the back of 2020. But are you prepared for what is yet to come?

One spark can brighten this (Covid-19) Christmas

December 8, 2020

2020 was not the year that many of us expected, but how it ends does not have to be the same.

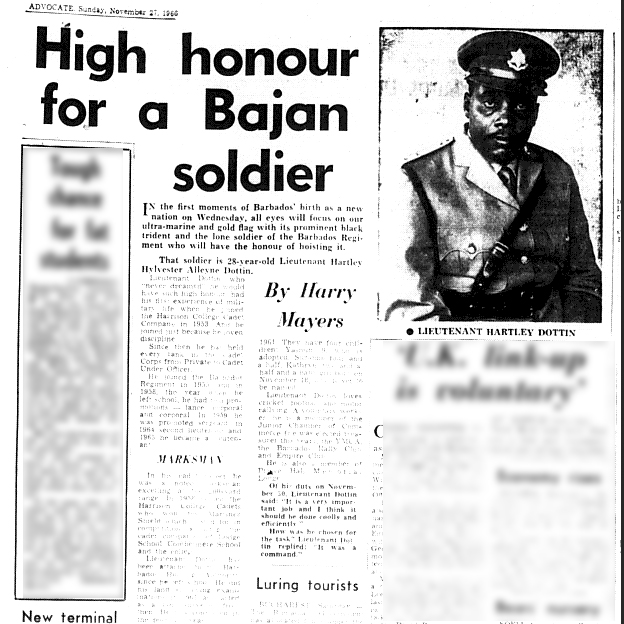

Happy Independence Day!

November 27, 2020

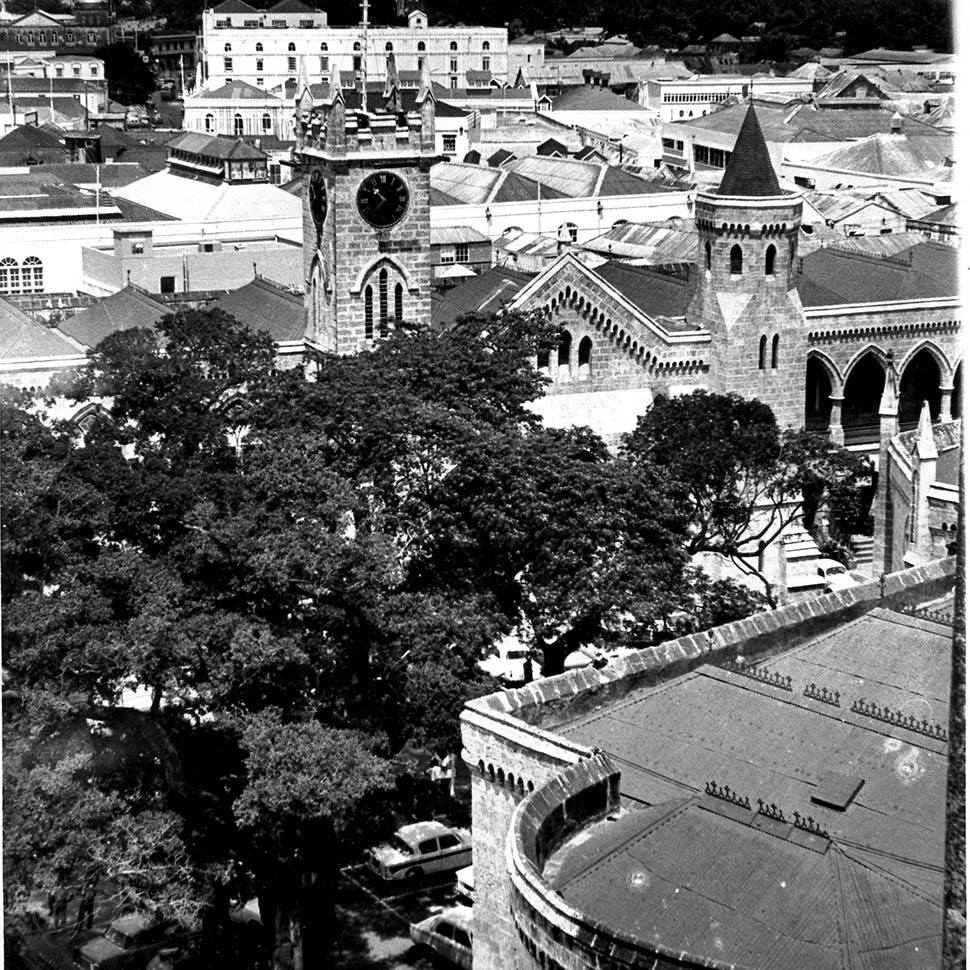

After 339 years as a colonial territory of Britain, Barbados stood on the precipice of Independence.

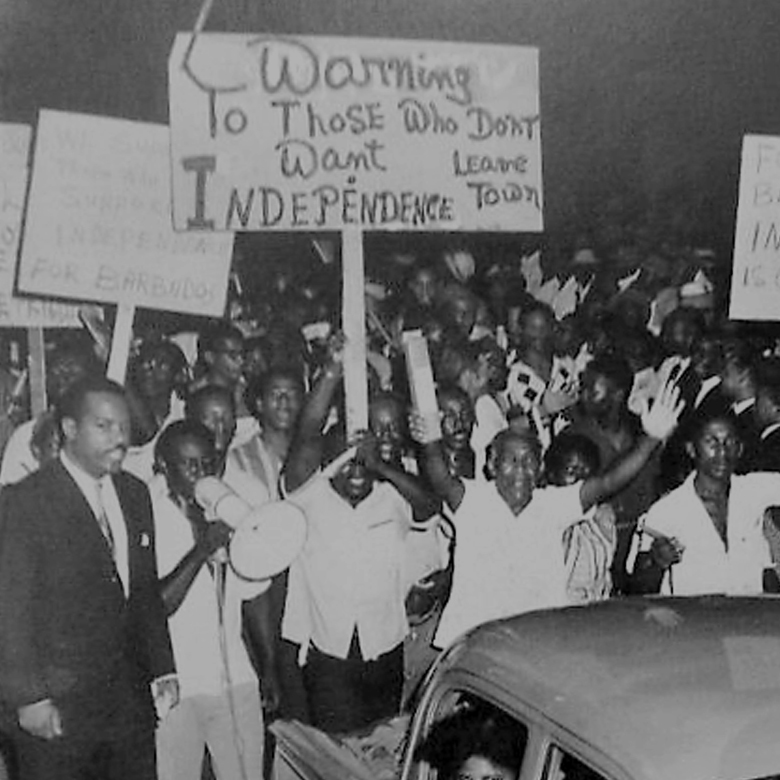

Independence 1966: One week to go

November 23, 2020

With the general election over, the nation turned its collectives eyes forward; towards Independence.

Independence 1966: The Election Results Are In

November 13, 2020

By November 4th of 1996 the election results were back. The three major parties all won seats, but only one would govern.

Independence 1966: What a Time To Be Alive

November 6, 2020

In November of 1966 Barbados is taking the final steps towards Independence. Let's take a stroll through history.

Buying a car: Insider tips that will save you money

October 5, 2020

Buying a car can be as much fun as it can be stressful. Here are some tips on how to minimise the stress, and increase ...

Covid-19 and the new normal. Are you ready?

September 16, 2020

Cooperation is key to moving forward into the "new normal".